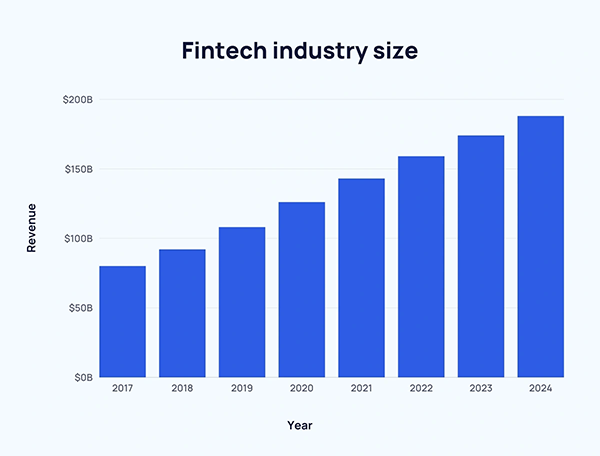

Do you have any idea about what Fintech is? For those who don’t know, fintech is made of two words, “financial” and “technology”. In simple language, when finance is mixed with technology and introduces innovations, it’s known as fintech.

CEO of IBM, Ginni Rometty once said “The future of finance is digital.” And if you look around you can see that cash flow is decreasing, but options like online banking are at their peak.

Fintech has been going through major changes, it has become more diversified and secure. From introducing unique payment options to blockchain, it has been doing everything for better customer service and satisfaction.

In this article, we’ll learn about 5 best-emerging trends in fintech. These trends are a must for business owners and can help them in various ways. Also, learn about Key Financial Metrics for Measuring Project Success by reading this article.

1. The Role of Artificial Intelligence in Fintech

Artificial intelligence (AI) is at the cutting edge of fintech innovations, modifying everything from customer service to fraud detection. A number of businesses in Hawaii are turning to Honolulu IT service experts for smooth integration of AI-driven solutions to process vast amounts of data and figure out patterns that would be difficult for humans to detect.

These technologies are helping companies automate their operations by automating repetitive tasks, improving efficiency, and driving down costs. One significant area where AI is making a difference is in fraud prevention. AI-powered algorithms can monitor transactions in real time and alert users to suspicious activity, providing businesses with an added layer of protection.

AI is also being used for tailoring customer experiences, with chatbots and virtual assistants offering 24/7 support and tailored financial advice. Moreover, many businesses are investing in improving the skills of their workforce to keep pace with the advancements in AI and fintech.

Programs such as masters in digital technology are starting to become increasingly popular as companies seek to equip their staff with the necessary skills to leverage AI to its fullest potential. With AI continuing to evolve, businesses that fail to make use of this technology risk falling behind their competitors.

2. The Rise of Digital Payment Platforms

Cash transactions are becoming exceedingly rare as digital payment platforms continue to take over the financial landscape. Businesses of all sizes are now embracing payment solutions like PayPal, Square, and Stripe to handle customer payments.

These platforms offer an array of benefits, including improved security, quick processing times, and the capacity to handle high volumes of transactions with ease. Moreover, digital payment platforms provide businesses with insights into customer behavior through advanced analytics, allowing companies to make more informed decisions about their financial decisions.

For small and medium-sized enterprises (SMEs), digital payment platforms remove the barriers traditionally associated with setting up complex payment systems. With just a few clicks, businesses can start accepting payments all over the world, which enhances their ability to diversify and succeed.

3. Blockchain Beyond Cryptocurrencies

Blockchain technology, often synonymous with cryptocurrencies like Bitcoin, is finding use cases beyond the world of digital currencies. Businesses are beginning to explore how blockchain can speed up operations, enhance security, and provide easy-to-understand processes across various industries.

At its core, blockchain provides a decentralized and indestructible ledger that ensures data privacy and secure transactions. One promising application of blockchain technology is in supply chain management. Companies can use blockchain to create tamper-proof records of every stage in the supply chain, allowing for greater transparency and accountability.

This technology is particularly useful in industries that require high levels of regulatory compliance, such as food safety, pharmaceuticals, and logistics. Moreover, for individuals exploring blockchain’s potential, platforms like Moonpay now make it easy to buy Bitcoin, providing an accessible and secure entry point into digital currencies.

4. Open Banking and API Integrations

Open banking is revolutionizing the way businesses interact with financial institutions. Through API (Application Programming Interface) integrations, open banking enables third-party developers to build applications and services around traditional banking infrastructure.

This allows for a more connected and streamlined financial ecosystem, where businesses can access financial data from various sources to make better decisions. One key advantage of open banking is that it provides customers with greater control over their personal financial information.

Instead of depending solely on banks to manage their data, customers can decide to share their information with trusted third-party providers. This leads to stronger transparency and a more robust financial services market.

DID YOU KNOW

The global online payment market was valued at $1.97 trillion in 2023. It is expected that by 2028 it will be increased to $12.06 trillion.

5. Embedded Finance

Embedded finance refers to the embedding of financial services into non-financial platforms, offering businesses the chance to enhance customer experiences by providing added flexibility. For example, e-commerce websites can now offer services such as loans, insurance, or even investment options directly through their service providers without requiring customers to leave the site.

This trend allows businesses to expand their revenue streams and offer value-added services that can help increase customer loyalty. By embedding finance within their services, companies create user-friendly customer experiences that make it easier for users to access financial products without the hassle of dealing with multiple service companies.

Conclusion

In conclusion, the fintech industry is evolving at a rapid pace, offering businesses new ways to improve efficiency, enhance customer satisfaction, and unlock new funding streams.

By staying up-to-date about trends like web-based payment platforms, AI, blockchain, open banking, and embedded finance, companies can catch up to these technological trends and remain relevant in an ever-evolving digital world.

Fintech is not just about financial services—it’s about revolutionizing how businesses operate and stay in touch with their customers in the modern age.