More than half of the world today has transformed their payment habits from paper to digitization.

Be it for usual groceries or lavish shopping, in this modern age, online payment methods have become the most convenient, flexible, and fastest way of transacting.

However, as the transaction joined the team of digitalization, the thieves too quickly adapted to these digital methods to carry out their illegal activities.

I’m sure you might be wondering how in such risks can you safely carry out your transactions every day.

The answer is again the advanced technology; they play a major part in facilitating these payments safely and securely.

They are aware that day-by-day cyber attacks are getting more and more sophisticated, therefore, they help ensure smooth and secure payments and safeguard your online transactions.

In this guide, considering the seven major points, we’ll learn the role of technology in safeguarding online transactions.

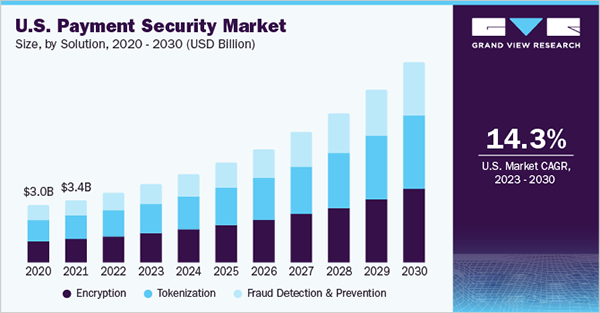

Encryption of data

You are not alone if you are worried about unauthorized parties getting hold of your sensitive transacting information.

This concern is dealt with through the encryption of data during transmission, and when you proceed with online payment, your data is converted into codes that are unreadable to everyone except the intended recipient.

Secure socket layer (SSL) and transport secure layer (TSL) protocols are used to encrypt your financial information in transit.

This acts as the first line of defense to protect your sensitive information shared online.

PayPal is a popular payment tool that most individuals now use to make transactions due to the extra level of security.

There are now many industries including online casinos that accept PayPal payments to offer extra protection and peace of mind to their customers who wish to deposit funds.

Payment Tokenization

When you process the transaction, your financial information is replaced with unique numbers or tokens.

These tokens are of no use to hackers and scammers, so even if intercepted, they involve no risk of data theft.

This tokenization provides immense help to businesses to keep client information secure, especially during repeated transactions.

Transparency

Transparency in online transaction methods builds user trust as well as enhances security.

Accessible records and real-time updates can help you detect any unauthorized activity in the account and prevent any fraudulent activity before it’s too late.

Transparent payment services also provide you with an assurance of compliance with safety measures and regulations.

Record tracking

You can easily access payment history and records of online expenses made, and these records can also help you ensure transaction security.

If you ever detect an anomaly or unusual pattern in your account activity, you can assess the payment records to make a clear trail of payment and hold parties responsible for those discrepancies and issues.

It also acts as a receipt to certify that the correct and desired amount of money was debited from the account and there was no fraud.

Multifactor authentication

Multifactor authentication or two-factor authentication is one of the most effective and reliable ways to ensure data security even when a user’s password is compromised.

You must have noticed that when you set up your account or make payments, you are required to provide multiple forms of verification such as passwords, biometrics, or one-time codes.

This acts as an extra layer of protection for your financial accounts, reducing the risk of fraud and scams.

Do You Know?

In 2023, there were 266.2 billion real-time payment transactions globally, which was a 42.2% increase from the previous year.

Fraud detection system

We discussed several ways that block unauthorized access, but what if a hacker or scammer somehow trespassed these measures?

You aren’t required to worry here in this case too as technology comes to the rescue here as well.

Suspicious patterns can be detected with advanced algorithms, machine learning, and real-time updates, and this can lead to flagging any unusual activity and preventing fraud at the right time.

Regular security update

Addressing vulnerabilities and working on limitations can significantly enhance payment security.

With the advancement of technology, cyber threats are also getting advanced, so it becomes vital to regularly assess and find areas of improvement to make the payment channels more secure.

Final Take

Online transactions worth billions are carried out every day, making it a necessity to have secure online payment methods.

After all that we have discussed in this article, we can say technology is a major tool in ensuring secure online payments.

From blocking unauthorized access to flagging suspicious activities, it helps in everything.

These security measures have helped people trust online payment methods, and now billions of people use digital transaction methods in their routine lives. Also, learn about Online Rent Payments Transactions Benefits by reading this article.

“The internet is a place where you can share your knowledge and skills. Payment should be as easy as sharing information.”- Jack Dorsey (Co-founder of Twitter and Square)